TOMATO CROP YIELD UPDATES

Will global tomato crops meet 2023 harvest estimates? We’re firmly in the latter half of 2023, yet tomato harvests in many countries are not nearing their yield estimates due to delays, heatwaves and more.

At Atlante, we track food industry trends nationally and globally to help our community stay informed. For tomato crops, as for many of this year’s vegetable crops, several converging issues and trends are resulting in unforeseen challenges to the 2023 harvest.

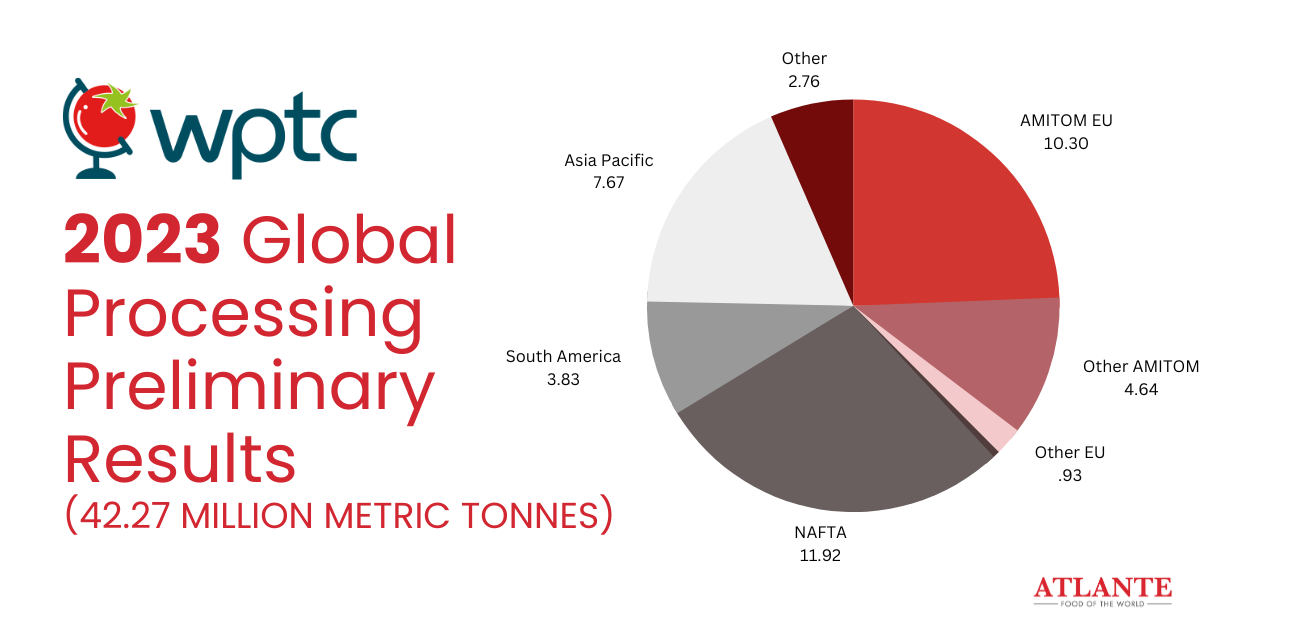

According to data from the World Processing Tomato Council (WPTC), the global world production estimate for tomatoes in 2023 is just over 42 million tonnes. As of 1st September, this remains the WPTC’s estimate- but they report “a lot of uncertainties as to the final volumes,” because many countries are still less than halfway toward reaching their estimated contributions to this number.

There are now just over three months left to make up the difference, and we are entering a critical time for tomato harvests. Delays, weather, insect infestations and seasonal changes all have a role in certain harvests coming up short.

Read on for a detailed look at which countries are on-track and off-track in regard to the above tomato harvest estimates, and what may occur to improve their 2023 yields.

2023 TOMATO HARVEST - HIGHEST FORECAST TONNAGE

California (10 900m tonnes): Southern California was negatively impacted by rainy August weather, with a few fields being entirely bypassed due to mould. September and October’s risky weather and harvesting conditions will be key to California’s yields. Approximately 40-45% of the crop has been harvested so far, and California will need to process tomatoes “at or near capacity” for the next 2 months in order to complete this harvest strong. Outlook: September and October are key to projected yield recovery.

Italy (5 500m tonnes): Northern Italy: After very high temperatures and a heatwave, only 42% of contracts have been processed so far. WPTC reports an average brix of 4.94 and penalties at 4.5% with the payment index at 98%. Lower yields than expected in Ferrara and Ravena have led to WPTC reducing forcasts for the region. Southern Italy: About 50% of contracts have been processed so far, with many factories required to stop processing briefly following heavy rains. High quality and medium brix have been noted. As overall yields have been lower than expected, the overall forecast for Italy is revised down from 5.6 to 5.5 million tonnes.

Turkey (2 600m tonnes): WPTC has labelled Turkey’s tomato crops “exceptionally late” with only about 45% of the surfaces harvested. Peak production should have been reached around 20-25 August, but it only arrived in early September. The forecast remains unchanged however, because of good weather and strong harvests expected from the Konya region which has not suffered from any high heat. Outlook: Very late crops are likely to meet yield estimates.

Spain (2 600m tonnes): A recent heatwave with temperatures above 40°C has negatively affected yields. The harvest is reaching its end in Andalusia, but in Extremadura the harvest is reaching about 65% of expectations. WPTC has not adjusted its estimated yields for Spain in total. Outlook: Lower yields so far but harvest continuing with better weather.

2023 Tomato Harvest - Mid-range FORECAST TONNAGE

Brazil (1 700m tonnes): A 5-7% reduction in volumes was caused by rain requiring transplanting to be redone. WPTC predicts another 7-8% reduction with low brix at fields (4.1-4.3 brix only). There is an expected reduction of about 15% in the crop size, down from about 2 million tonnes to 1.7 million tonnes.

Portugal (1 500m tonnes): The first half of the crop has been successful with a smooth summer season, and if Portugal kept that up, they could exceed forecasts. Unfortunately, the second half of the crop has reduced yields that may be reduced further due to insect infestations. To date, 67% of the forecast has been processed and the harvest should continue with significant volumes in the month ahead. Outlook: Reduced yields are saved by a successful start to the season.

Egypt (600m tonnes): Summer heat waves have had a negative effect on recent yields, but the late summer crop is just beginning. The situation is being assessed and the overall forecast will be reviewed in coming weeks. Winter crop plans have been delayed in order to avoid the heatwave, so transplanting for the winter crop will begin mid-September. Outlook: Smaller yields, but possible upcoming end to delays.

Greece (430m tonnes): With good weather, WPTC reports that Greece’s field yields are very good and have an average brix of 5. Greece has been processing slightly less than its usual number of tomatoes at this point (75% of the forecast has been processed in the south so far) but the total forecast remains unchanged. Outlook: Likely to achieve forecasted yields.

2023 TOMATO HARVEST - LOWEST FORECAST TONNAGE

France (160m tonnes): Summer yields are better than expected, with good quality and yields considering fruit fly issues and blight in late spring, but France has only processed 50% of its forecasted yields to date. Brix is about 5 and penalties 6%. A disruptive heatwave has now passed. If September has good weather, WPTC predicts France’s 160,000 tonne forecast should be achieved. Outlook: Behind schedule, but strong yields possible.

Hungary (100m tonnes): Tomato harvesting in Hungary is going well with average yields and good Brix. The plan is unchanged at 100,000 tonnes, and 1/3 of the total quantity has been processed at this point. Outlook: Estimates likely to be reached.

Japan (30m tonnes): Growth has been relatively smooth recently in the Kanto and Chubu regions and is almost completed. Soon, harvesting will begin in Hokkaido where the lingering effects of drought may impact yields. However, WPTC projects that the total volume of tomatoes to be processed by Japan is unchanged. Outlook: Going strong with possible drought issues ahead.

WPTC has also shared that there are no changes to report for China, and stable tomato processing ongoing in Tunisia.

ADVICE FROM ATLANTE

To ensure your own business is informed and prepared, we recommend that you consider taking the following actions:

- Confirm your producer’s purchasing volumes.

- Request updates on quality levels of tomatoes.

- Check your producer’s production plans post any delays or pauses.

The more you know, the better production, transportation, processing, marketing, packaging, and distribution choices you can make down the line. For support at every step along the way, reach out to us at Atlante.

You can get even more tomato processing industry insights by downloading our guide:

Monthly pace of tomato paste imports remains high

Tomatoes: RIPE FRUIT harvest News

As the tomato harvest comes to a close here's a quick summary of what we have learned which helps...